Depreciation equation calculator

This depreciation calculator is for calculating the depreciation schedule of an asset. As the truck has been used and.

Depreciation Calculation

This free downloadable PDF is fantastic for calculating depreciation on-the-go or when youre without mobile service to.

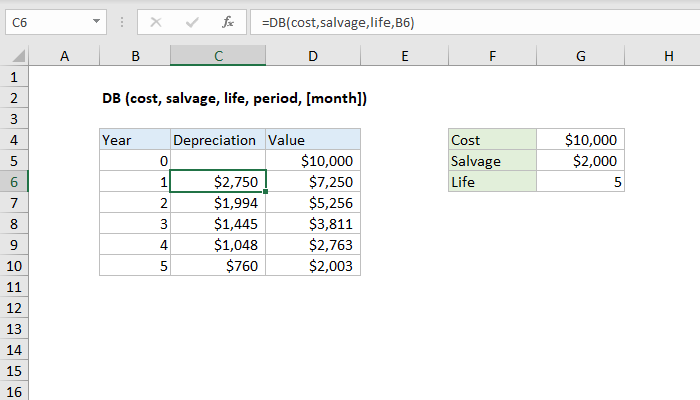

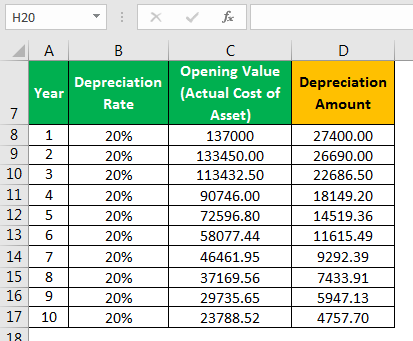

. There are three methods to calculate depreciation - the straight line depreciation the declining balance depreciation and the sum of years digits depreciation. Calculate the revised depreciation and make the journal entry for revised depreciation in year 3 and year 4. Calculate the revised depreciation.

The algorithm behind this straight line depreciation calculator uses the SLN formula as it is explained below. Non-ACRS Rules Introduces Basic Concepts of Depreciation. Enter your starting quote exchange rate 1.

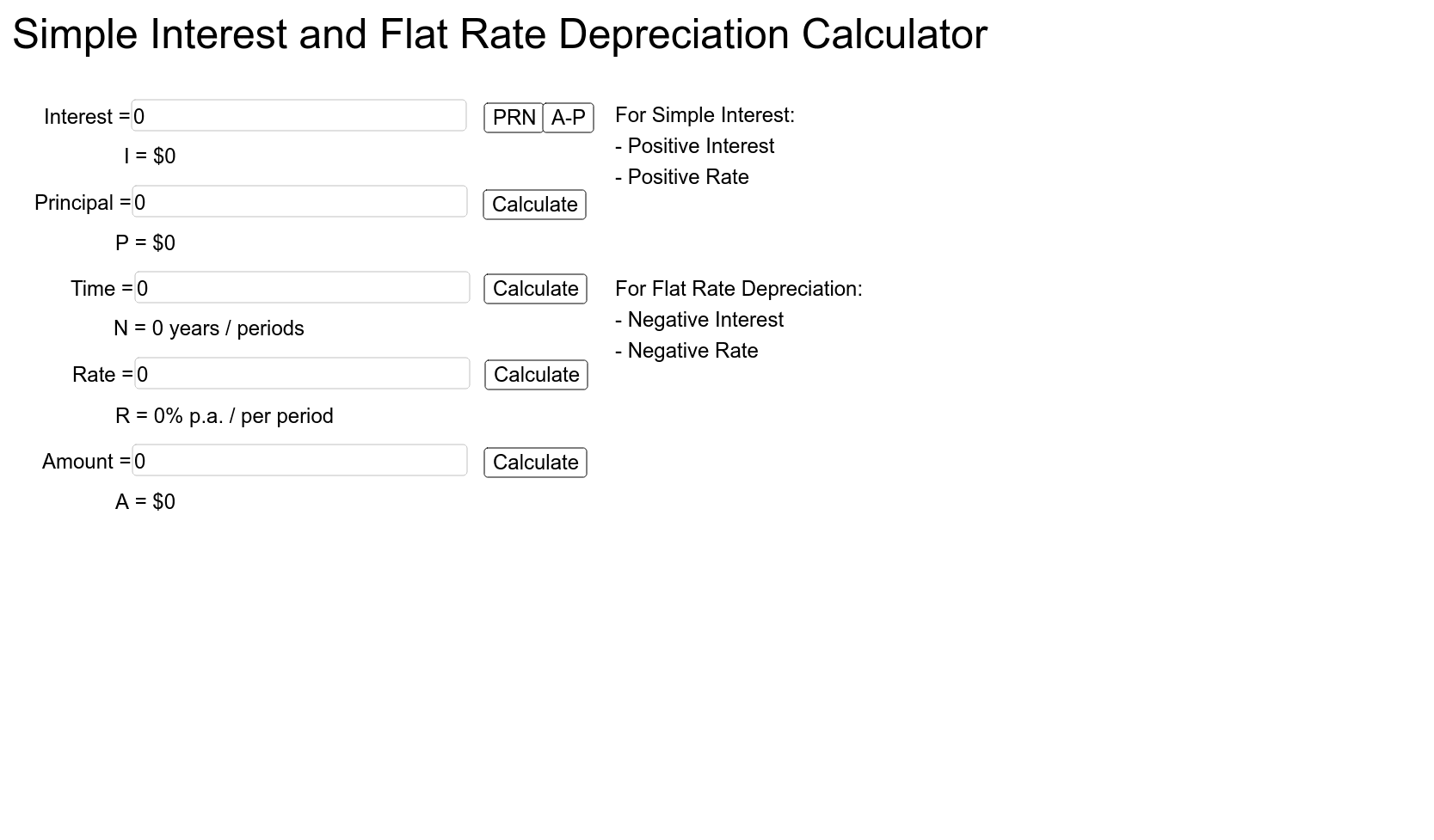

Percentage Declining Balance Depreciation Calculator. Where Di is the depreciation in year i. Select your Quote Currency.

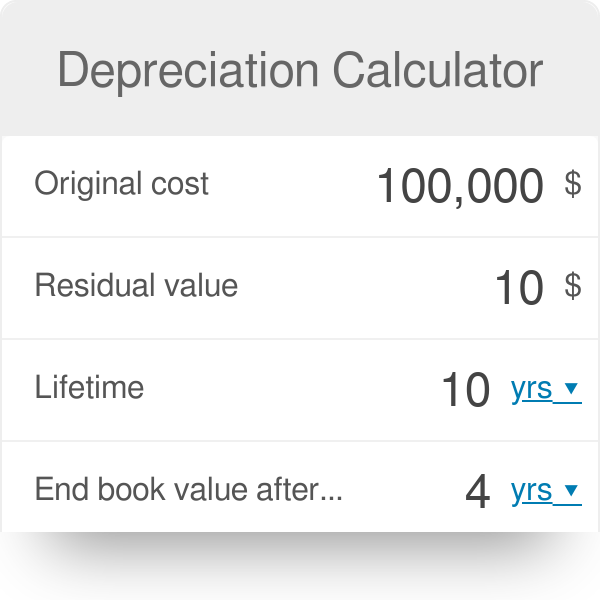

Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. This car depreciation calculator is a handy tool that will help you estimate the value of your car once its been used. C is the original purchase price or basis of an asset.

The calculator also estimates the first year and the total vehicle depreciation. Depreciation is a method for spreading out deductions for a long-term business asset over several years. The basic way to calculate depreciation is to take the.

These are set at 1 base currency unit. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. For example if you have an asset.

It is fairly simple to use. 21 Fixed Installment or Equal Installment or Original Cost or Straight line Method. Here is the step by step approach for calculating Depreciation expense in the first method.

The MACRS Depreciation Calculator uses the following basic formula. DOWNLOAD THE CLAIMS PAGES DEPRECIATION GUIDE. This is the cost of the fixed asset.

D i C R i. Depreciation Per Year is calculated using the below formula. This depreciation calculator will determine the actual cash value of your Power Tools using a replacement value and a 20-year lifespan which equates to 02 annual depreciation.

Select the currency from the drop-down list optional Enter the. 2 Methods of Depreciation and How to Calculate Depreciation. Calculate the depreciation to be charged each year using the Straight Line Method.

All you need to do is. 22 Diminishing balance or Written down. The formula for calculating.

First one can choose the straight line method of. Depreciation Per Year Cost of Asset. You probably know that the value of a vehicle drops.

Select your Base Currency that you want to quote against. It provides a couple different methods of depreciation. Periodic straight line depreciation Asset cost - Salvage value Useful life.

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator Depreciation Of An Asset Car Property

Depreciation Calculator Definition Formula

Straight Line Depreciation Formula And Excel Calculator

How To Calculate Depreciation Youtube

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

How To Use The Excel Db Function Exceljet

Accumulated Depreciation Definition Formula Calculation

Depreciation Formula Calculate Depreciation Expense

How To Calculate Depreciation

Declining Balance Depreciation Calculator

Depreciation Rate Formula Examples How To Calculate

Straight Line Depreciation Calculator Double Entry Bookkeeping

Free Macrs Depreciation Calculator For Excel

Simple Interest And Flat Rate Depreciation Calculator Geogebra

Depreciation Formula Calculate Depreciation Expense